Billing Automation

Billing automation

Billing automation for digital business models

Billing automation as solid basis

Contracts and billing automation are the basis of any business. Whether your business model is based on recurring billing (subscription), one-time sales of products and services, or usage-based data: You monetize these models or combinations of them directly via JustOn.

That is why the software is ideal for monetizing innovative business models, based on subscriptions, commissions and marketplace scenarios.

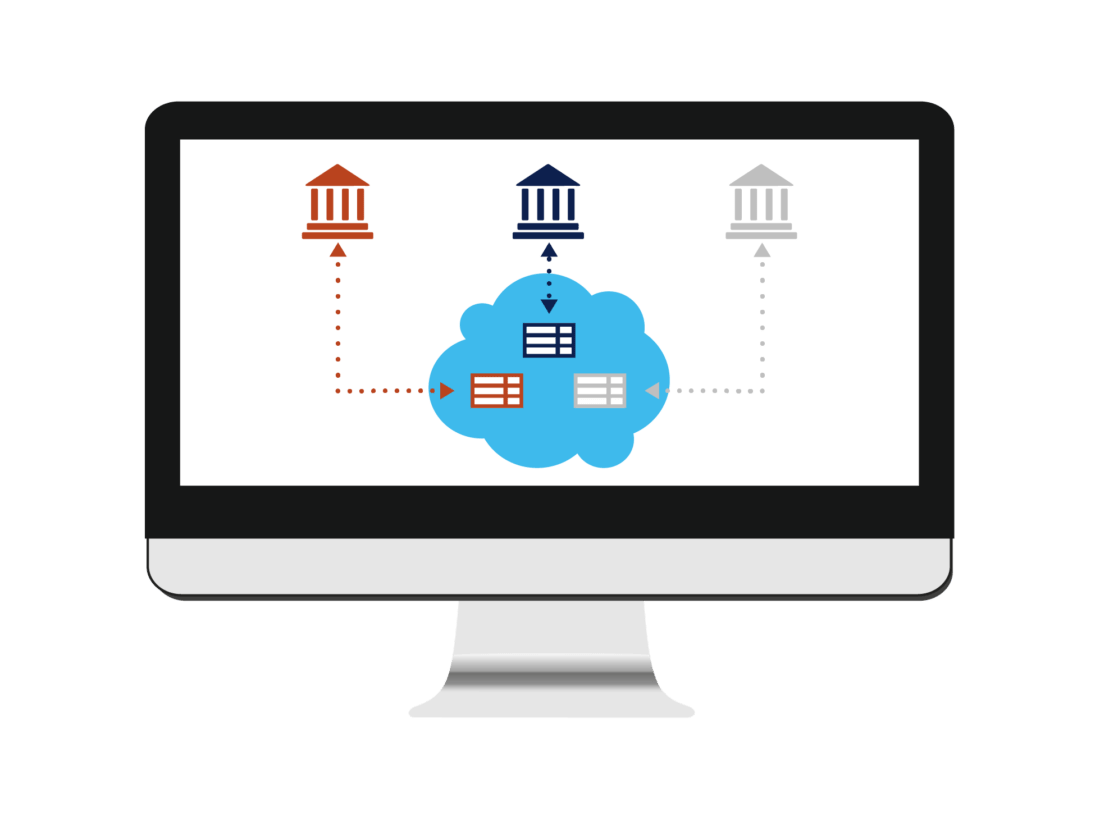

JustOn automatically retrieves all relevant data from your CRM, ERP, project management or issue tracking systems as the basis for the invoice generation.

Mapping any contract model

In JustOn, you model your contracts manually or have them built automatically. The resulting billing plans make up the „blueprints“ for the future invoices. They combine the relevant customer data with the details of the products or services to be charged, which will figure as invoice line items on the created invoices.

JustOn allows for flexibly creating contracts, supporting

- Service periods

- Automatic renewals

- Cancellation terms

- Rule-based price increases

You can also create invoices directly from arbitrary objects or opportunities, bypassing the billing plans.

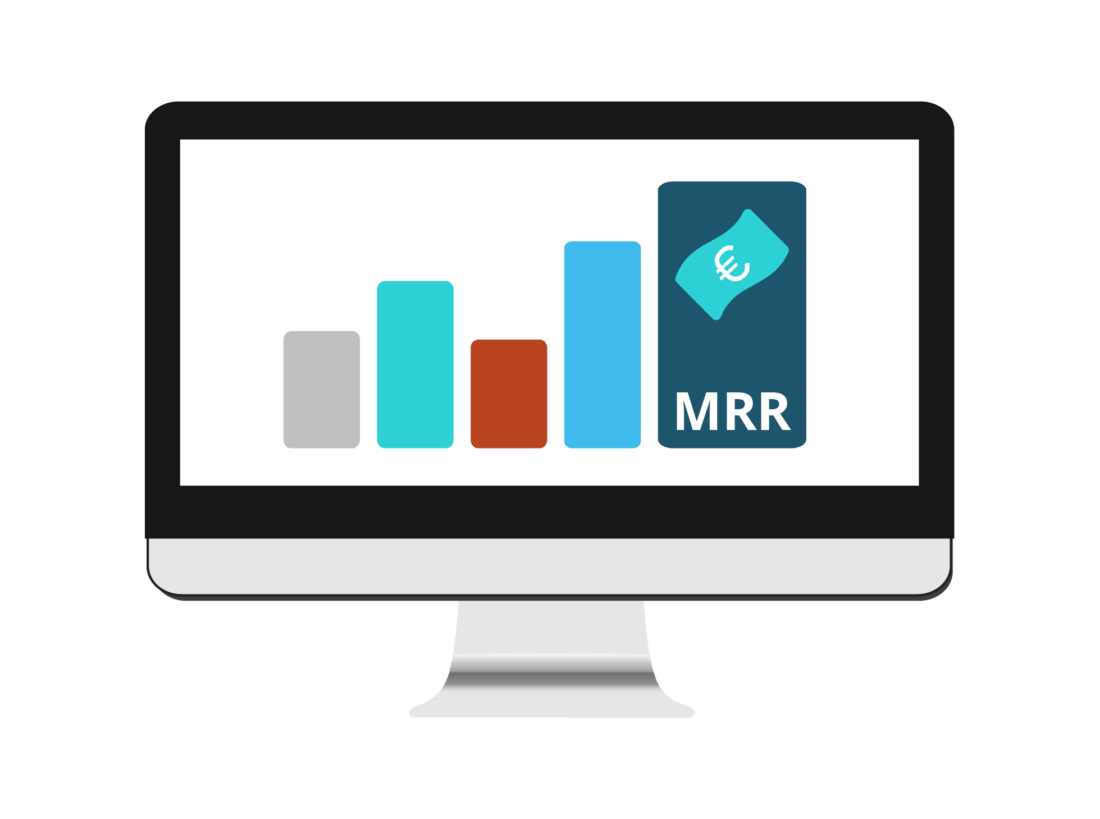

Unlimited Pricing Options

Using JustOn, you quickly set up and monetize every pricing or business model. The software includes multiple preconfigured models and provides the possibility to configure new models according to your needs. Define your pricing models and billing periods, keeping the option to modify or adjust them according to your business and processes.

JustOn provides unlimited possibilities to configure your product and service offering. Without great effort, you define any pricing and billing models:

- One-time payments for products and services

- Reccuring billing for subscriptions

- Usage-based billing (time, clicks, numbers, orders)

- Commission-based contracts (revenue, quantity)

- Flat rates and tiered prices

- Quantity discounts or bundled pricing with a minimum fee

- Prices with start and end dates

- Payment plans (installments)

Subscriptions, commissions and marketplaces

ou run a marketplace, sell subscriptions or invoice service packages in combination with individual usage data? In any case, JustOn is the perfect billing solution for your business model. Several recipients, multiple currencies or different languages do not cause problems.

Innovative, forward-looking business ideas are characterized by flexibility. With JustOn, you flexibly model your business scenarios so that they always meet the rapidly changing market conditions and customer needs in the best possible way.

Flexible pricing models and wide-range offerings improve the customer relationship and drive your economic success.