Professional Services

Professional Services

Automated financial processes for more focus on the core business

Digitization empowers knowledge-intensive business services (KIBS)

Professional services – as providers of knowledge-intensive and consulting services – are part of a growing industry.

Specific to this segment is the strong focus of its experts on their specialist tasks.

And this is where digitization can make the decisive difference.

Multiple areas of application

The industry is characterized by a particularly wide variety of application areas. These include, among others:

- Management consulting

- Human resources consulting

- Engineering offices

- Law firms

- Financial Auditors

- Advertising and marketing agencies

- Software solution providers

Challenges for professional service provider

Particularly in professional services, it is essential to keep the high administrative workload to a minimum.

This is the only way the experts can focus on their core competencies: knowledge and consulting.

To get there, providers need digitized and thus automated processes for managing customers, projects, billing, invoicing and accounting.

JustOn offers solutions for professional services

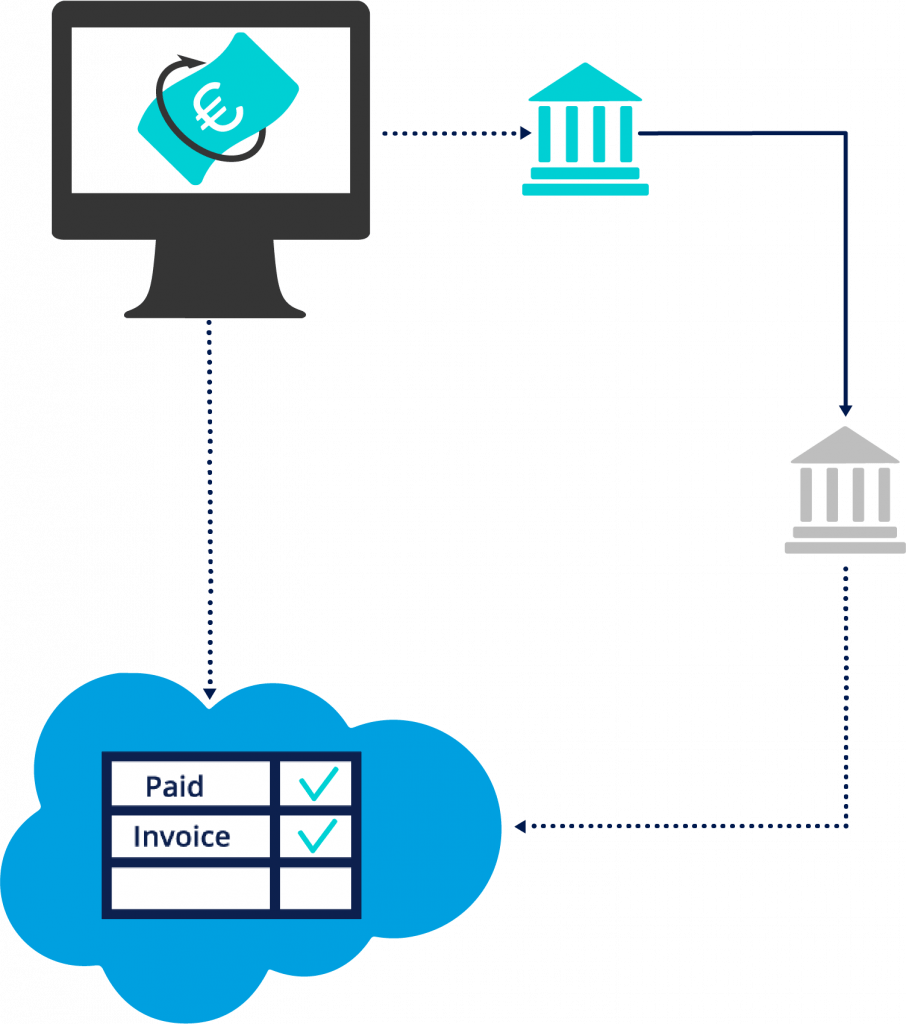

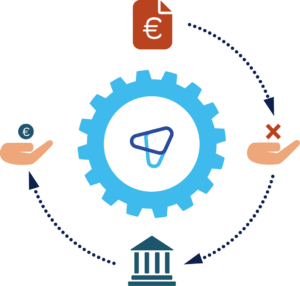

Automatic Payment Reconciliation

Automatic payment reconciliation – JustOn provides automatic reconciliation of payments and invoices in Salesforce.

Banking in Salesforce

JustOn offers banking in Salesforce via an bank integration, compliant with the Electronic Banking Internet Communication Standard (EBICS).

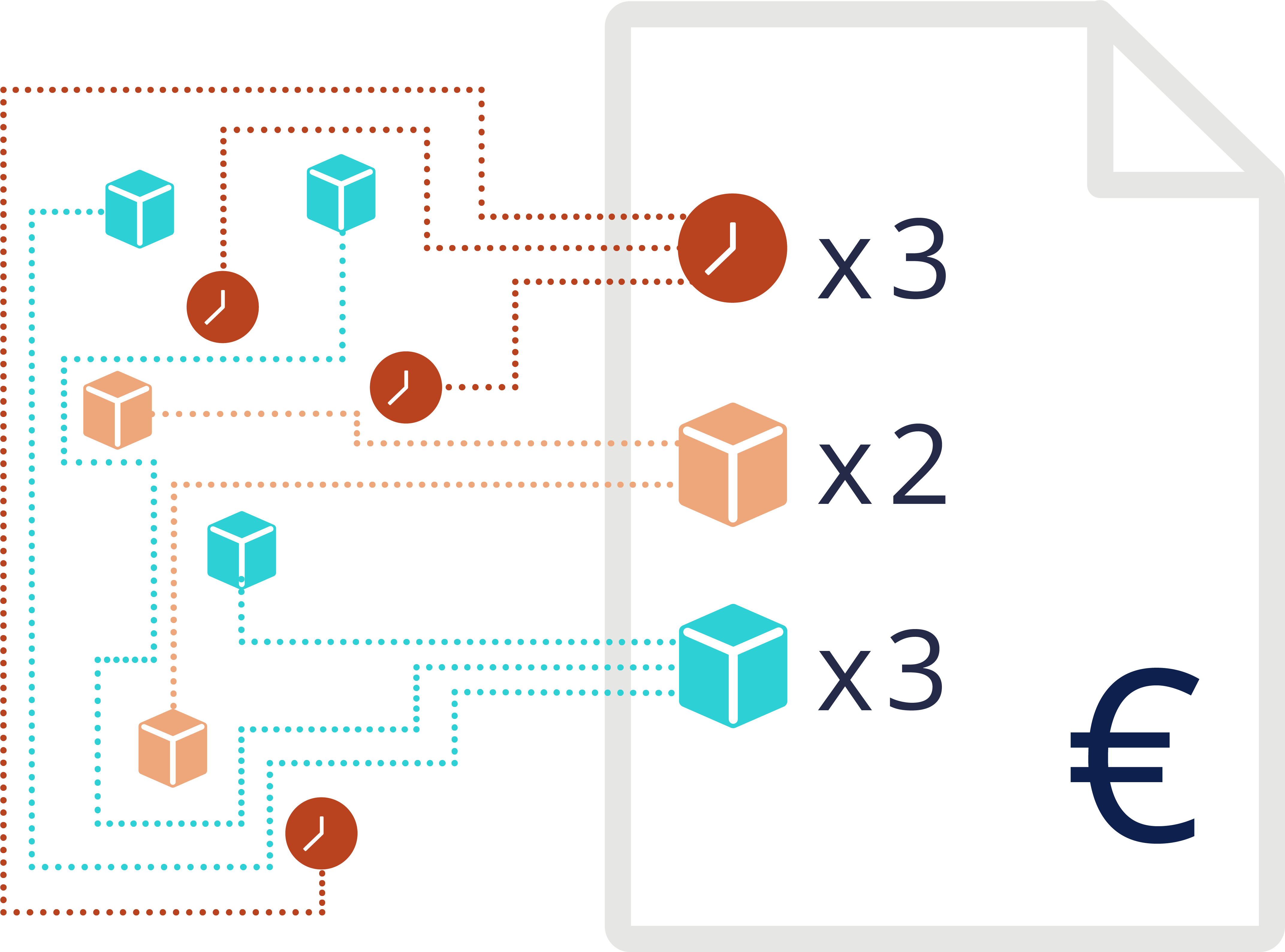

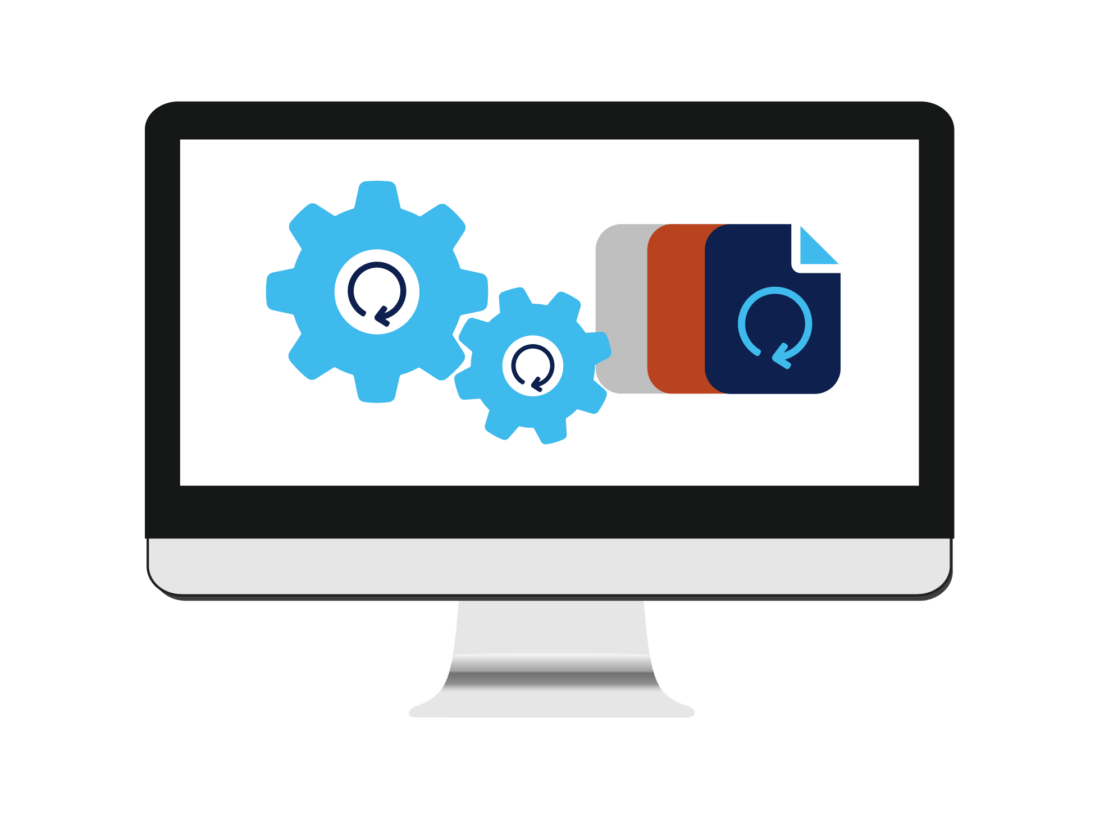

Billing Automation

Billing automation: Configure every contract model. JustOn retrieves relevant data from backend systems for generating digital invoices.

Invoice Management

Invoice Management: JustOn automates digital invoice processes: preparation invoice data, generation, distribution and archiving of invoices.

So nutzen Professional-Service-Anbieter unsere Produkte

Sorry, no posts matched your criteria.