Recurring Billing

Recurring Billing

Recurring billing of subscriptions in Salesforce

Recurring billing – a model for success

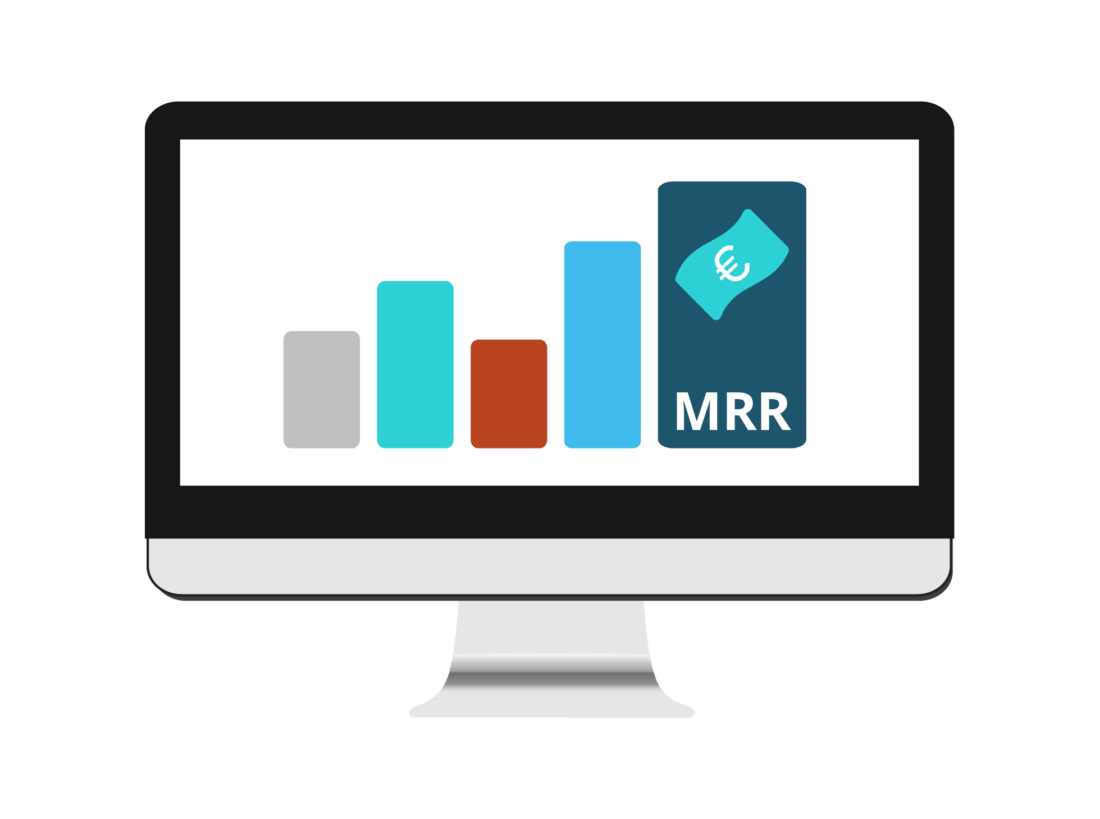

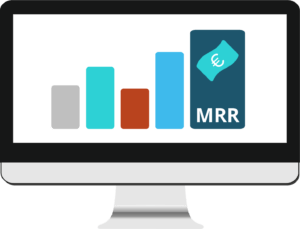

Subscription billing – the recurring billing based on subscriptions and periodic contracts – is a particular strength of our software. Creating recurring invoices is based on an automated process that enables companies to generate and send invoices to their customers at regular intervals.

Recurring billing is an important part of the subscription management, the most successful business model of our time. This model owes its success to several key advantages it offers companies and customers compared to one-time sales.

Benefits of Subscription Billing

A subscription model allows companies to combine details like products, prices and terms in one contract, the billing of which can be easily automated. Using subscriptions, end customers are given the flexibility to buy products and services precisely according to their own needs.

These contracts, which are typical for subscription management, offer further benefits for companies and their customers: Through regularly receiving payments, companies can better assess their liquidity, prospectively plan their finances, and build long-term customer relationships. Customers, on the other hand, benefit from predictable, regular and constant expenses and their planning over a long term.

Subscriptions as basis for recurring billing

Subscription contracts record and manage all data relevant to billing:

- Items in the form of products or services

- Pricing model including price tiers, discounts and automatic price increases

- Options for installments

- Start and end dates of the contract

- Due dates

The subscription becomes the billing plan for both parties. From the subscription, JustOn Billing & Invoice Management collects all the invoicing-relevant data and creates your invoices via an automatic invoice run.

To this end, it combines account information such as name and address with the products booked in the subscription contract, the pricing model and the due dates.

From invoice to payment

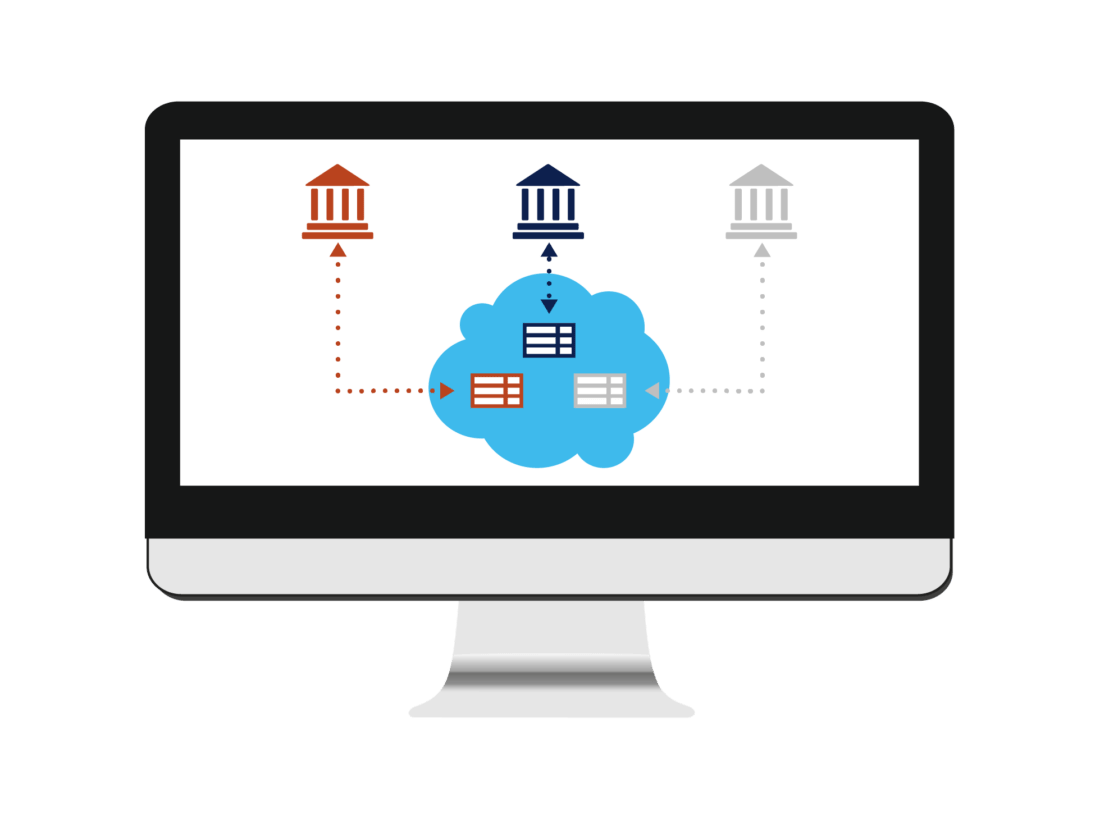

The regular generation of recurring invoices is seamlessly followed by the distribution to customers, SEPA direct debit collection, automatic verification of incoming payments, receivables management via an automated dunning run, and payment reconciliation.

Customers can pay their invoices directly via the payment page of JustOn Cash Management or, in prospectively issue a SEPA mandate for direct debit collection.