Payment via Payment Provider

Payment via Payment Provider

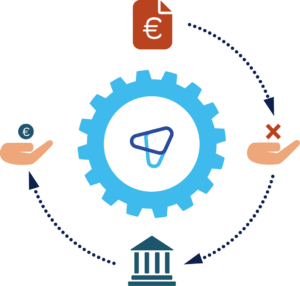

Integrated payment service provider for direct online payments

Advantages of payment providers

A payment service provider (PSP) – also known as a payment gateway – is a service provider that offers companies the technical integration of various payment types.

PSPs automate online payments and are therefore an important basis for online sales. They make it easier for companies to sell products and services, as they offer their customers multiple payment methods via a single contractual partner.

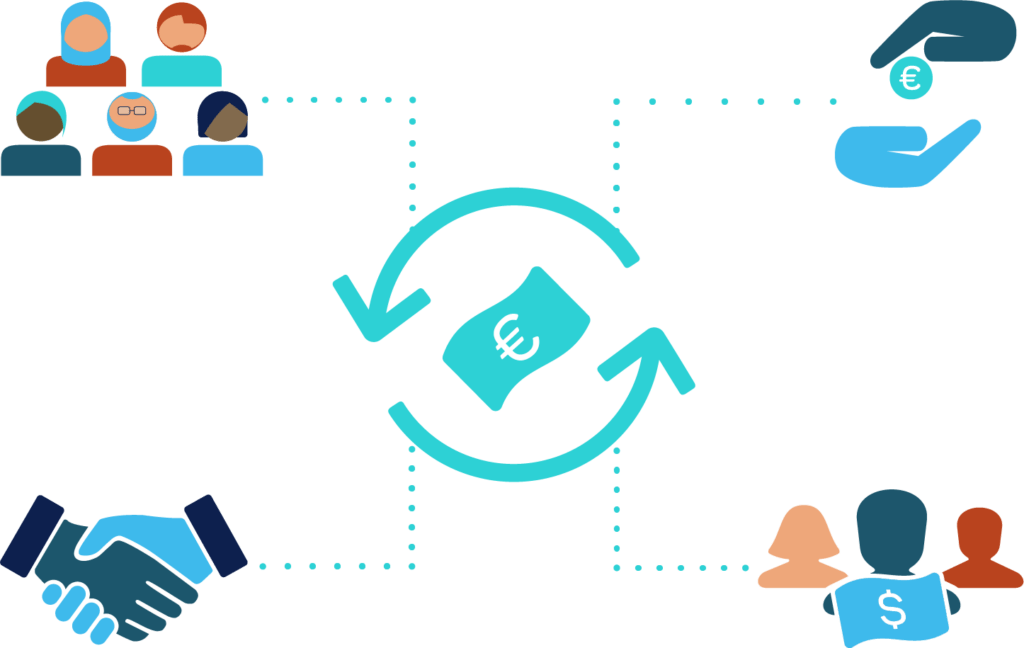

Possible online payments via payment providers

Payment providers enable companies to offer their customers common payment methods, such as payment by:

- PayPal

- Apple Pay

- Klarna

- Cards (Visa, MasterCard, EC etc.)

- SEPA direct debit

Using a payment service provider saves time and money and offers companies and their customers fast and secure payments.

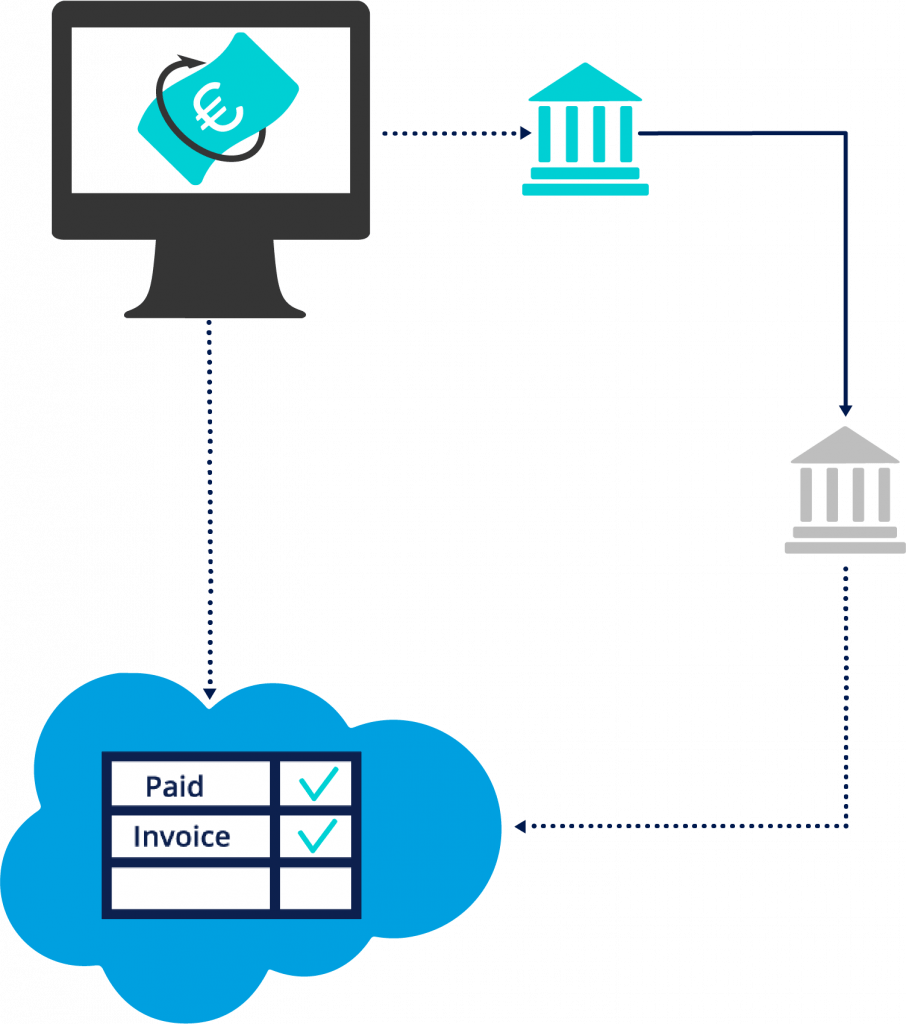

Direct connection to payment provider Mollie

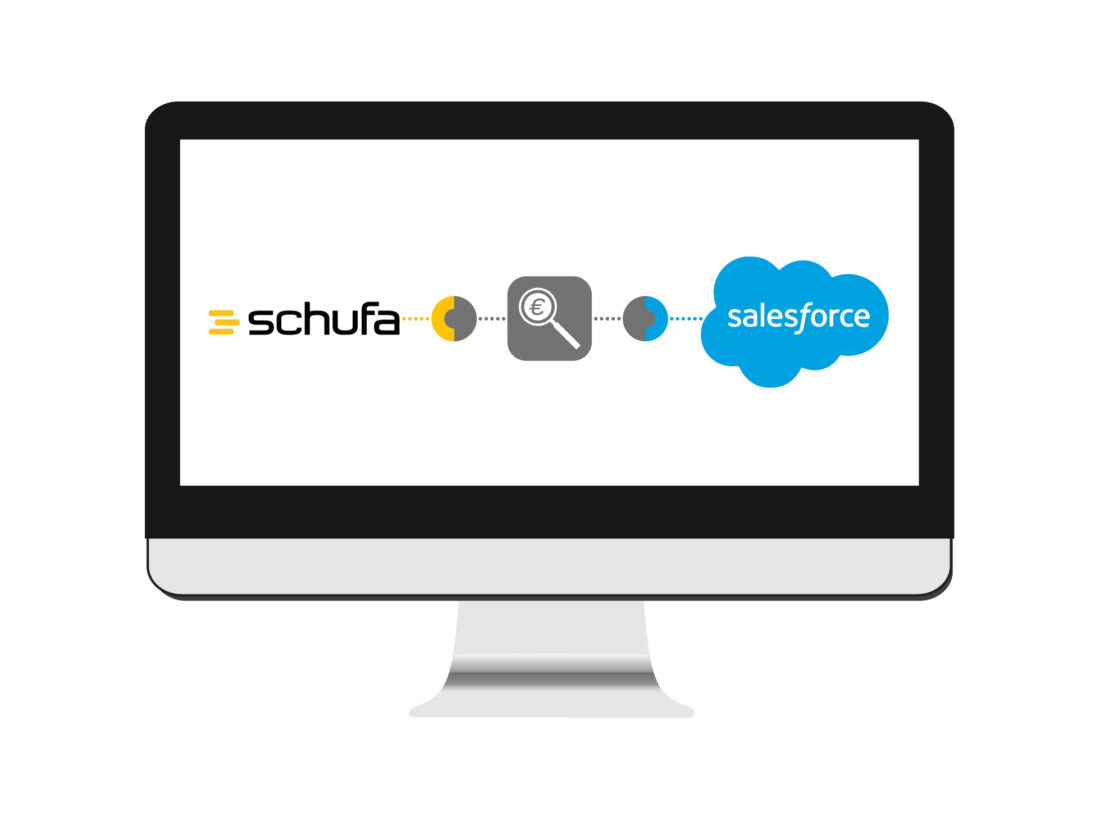

JustOn therefore offers companies integration with the popular and secure payment provider Mollie, which enables the above-mentioned online payments and many other payment methods.

Our product JustOn Cash Management integrates this payment service provider into your Salesforce org in order to exchange payment data via. This enables your customers of pay for purchases of products or services using a payment page and the payment methods of their choice.

Find out more about the technical details and requirements in our technical documentation.